How to Stay Top of Mind When Investors Are Evaluating 30 Other Companies

- Bella Battsengel

- 4 days ago

- 7 min read

Every investor you are speaking to right now is also having conversations with at least 30 other companies.

This is not an exaggeration. This is the reality of private capital deal flow in 2026.

The question is not whether you can pitch well. The question is how you stay top of mind whilst investors are drowning in competing opportunities.

Most founders lose deals not because their business is inferior. They lose because they disappeared from investor consciousness whilst evaluation was happening.

Capital Raising Is a Marketing and Sales Process

Capital raising is fundamentally a marketing and sales process. First, you build the pipeline. Second, you run prospects through the sales process.

You need to treat it like that.

This psychological reframing helps you understand that rejection is not personal. It is part of the process. When you understand at your fundamental core that capital raising is marketing and sales, it shapes how you reference every rejection and every acceptance.

Your business is the product. Investors are the buyers. The sales cycle is long. The consideration set is crowded. You need multiple touch points to stay relevant.

This is not intuitive for most founders. Technical founders especially struggle with this framework. They believe the quality of their technology should speak for itself. It does not.

Commercial founders understand this instinctively. They have sold products before. They know that buyers need repeated exposure before they act. The same principle applies to capital raising.

The Mere Exposure Effect in Capital Raising

There is a well-documented psychological principle in marketing called the mere exposure effect. The more contact points someone has with a business, product, or brand, the more they develop an opinion about it.

This opinion can be positive or negative. But familiarity increases the likelihood of engagement.

In capital raising, this means you need at least seven touch points with investors before they are ready to participate. Not seven pitches. Seven different types of exposure to your company.

Most founders create one or two touch points. An initial pitch meeting. A follow-up email. Then silence.

This is insufficient. Whilst you disappeared, 29 other companies continued creating touch points. Your opportunity faded from investor consciousness. When their timing aligned and they were ready to deploy capital, you were not top of mind.

The 7 Types of High-Value Touch Points

Touch points are not spam. They are not "just checking in" emails. They are not calls asking if the investor has made a decision yet.

Touch points are high-value engagement opportunities that allow investors to understand your company better. To see your progress. To develop familiarity with your trajectory.

1. Social Media Updates

LinkedIn posts about company milestones. Product launches. Customer wins. Team expansions. These create passive exposure for investors who follow you.

The key is consistency. Not volume. One high-quality post every two weeks showing genuine progress is more valuable than daily posts about minor updates.

Investors are on LinkedIn. They scroll between meetings. Your posts create micro-moments of engagement that keep you present in their awareness.

2. Media Features and Coverage

When you secure media coverage, communicate it. Not just the article itself. The fact that credible publications chose to feature your company is a validation signal.

Industry publications. Tech news sites. Sector-specific media. Each feature creates a touch point and adds third-party credibility to your narrative.

Forward the coverage to your investor distribution list with minimal commentary. Let the media coverage speak for itself.

3. Video Content

Video creates deeper engagement than text. A two-minute founder update explaining recent progress. A product demonstration. A customer testimonial.

Video humanises your company. It allows investors to see the founder, feel the energy, and understand the culture. This builds familiarity faster than written updates.

You do not need production quality. You need authenticity and substance.

4. Investor Relations Communications

Regular updates to your investor distribution list. Every one to two months. Not selling. Informing.

What milestones did you hit. What customers did you sign. What partnerships did you close. What challenges are you navigating. What help do you need from your network.

These updates keep passive investors engaged. They allow investors who are not ready to participate now to track your progress for future rounds.

Most importantly, they demonstrate consistent execution. Investors see month-over-month progress. This builds confidence in your ability to deploy their capital effectively.

5. Information Sessions and Boardroom Presentations

Hosting information sessions for potential investors. Either virtual or in person. These create structured touch points where investors can ask questions and engage directly.

Boardroom presentations to family offices or investment committees. These are higher-intent touch points because investors have already expressed enough interest to allocate time for detailed evaluation.

The goal is not to close in these sessions. The goal is to deepen familiarity and understanding.

6. Conference Appearances

Speaking at industry conferences. Presenting at pitch events. Participating in panel discussions.

When you feature at conferences, invite investors from your pipeline to attend. Give them a reason to see you in a different context. To hear you speak about industry trends. To watch you handle questions from the audience.

This creates social proof. If you are credible enough to speak at a respected conference, you gain credibility by association.

7. Pitch Event Invitations

If you are invited to pitch at events, invite investors who are following your company to connect with you there.

This serves multiple purposes. It creates another touch point. It allows them to see you pitch to a broader audience. It provides a low-pressure environment for informal conversation after your presentation.

Investors who attend pitch events where you present are signalling higher interest. They invested time to see you. This is a qualification signal that helps you prioritise your pipeline.

Active Versus Passive Investor Engagement

When you are raising capital, you will notice two types of investors. Those who actively engage with you. Those who passively engage with you.

Passive investors follow everything you are doing. They read your updates. They watch your LinkedIn posts. They track your progress. But they do not talk to you.

This does not mean they are uninterested. It means they are not ready to act yet. Their timing has not aligned. They are watching and waiting.

Every touch point you create serves both groups. Active investors get deeper engagement. Passive investors maintain awareness.

You are planting seeds. You do not know when they will generate opportunities. You do not know which seed will produce the return. But you must trust the process.

Why Repetition Builds Trust

Fundamentally, repetition builds familiarity. Familiarity builds trust.

Investors receive hundreds of opportunities. Most fade after one or two interactions. The companies that stay present through consistent, high-value touch points become familiar.

Familiarity reduces perceived risk. When an investor has seen your progress over six months through multiple touch points, they have more confidence in your execution capability than a company they met once.

This is not about manipulation. This is about giving investors enough exposure to your company to make an informed decision.

Do it consistently over time. Not all at once. Seven touch points compressed into two weeks does not work. Seven touch points spread over six months creates genuine familiarity.

How This Changes Capital Raising Outcomes

This approach is how you stand out when investors are drowning in deal flow. They are getting deals sourced from every direction. Advisors. Other founders. LinkedIn messages. Cold emails.

The companies that disappear after one meeting get forgotten. The companies that maintain consistent, high-value touch points stay top of mind.

When an investor's timing finally aligns. When they have allocation capacity. When their thesis matches your sector. You want to be the first company they think of.

This only happens if you have created enough touch points to establish familiarity.

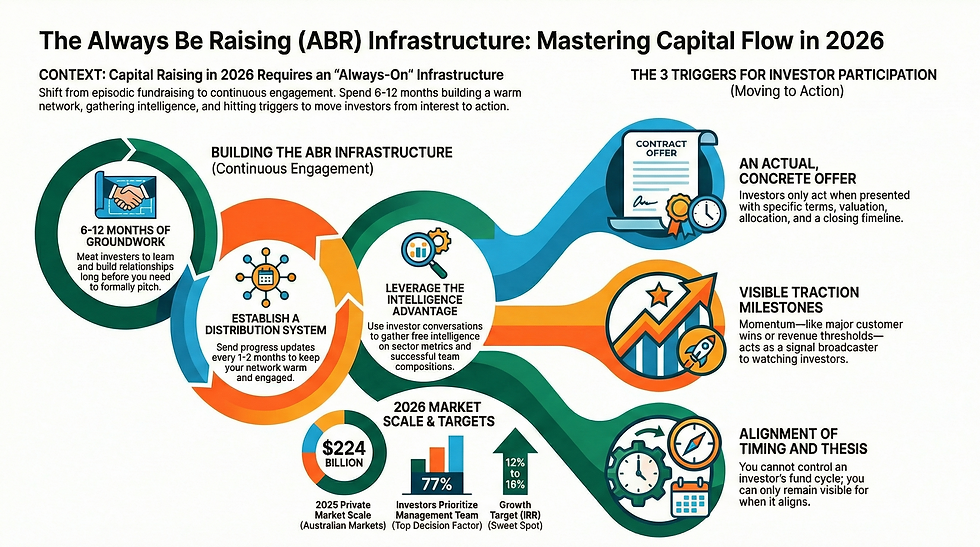

The Infrastructure Advantage in 2026

The Australian private market raised $224 billion in 2025. Capital exists. Investor appetite for high-growth opportunities remains strong.

But the signal-to-noise ratio has never been worse. Investors cannot evaluate every opportunity deeply. They filter based on familiarity and credibility signals.

The founders winning capital are not necessarily building better businesses. They are building better investor engagement infrastructure.

Always-on investor relations that create systematic touch points. Automated updates when milestones hit. Consistent communication that keeps investors engaged without consuming founder time.

This infrastructure separates efficient capital raisers from founders who spend months chasing investors who forgot about them.

According to recent surveys, 77% of investors highlight management team as the primary decision factor. But familiarity with the team matters as much as their credentials. Investors need repeated exposure to develop confidence in founder capability.

Seed-stage opportunities captured 38% of investor interest in 2025. Series A and B rounds remained preferred at 45%. But the companies closing these rounds fastest are the ones that maintained investor engagement from their previous raise forward.

They never went cold. They kept investors warm through systematic touch points. When they opened their next round, investors were ready to participate immediately.

The Question You Need to Answer

How many touch points have you created with your potential investors. How many are you systematically creating in your capital raising process.

If the answer is fewer than seven, you are losing deals to companies with better engagement infrastructure. Not better businesses. Better systems.

The best founders in 2026 are not spending 80% of their time on investor relations. They have infrastructure that handles systematic touch point creation. They focus on building their business. The system maintains investor engagement.

The worst founders are still sending "just checking in" emails. Still wondering why investors stopped responding. Still losing deals they should have won.

The difference is infrastructure. Always-on systems that create high-value touch points without manual effort. That keep you top of mind whilst 30 other companies fade from investor consciousness.

Capital raising is a marketing and sales process. The companies that understand this reality and build appropriate infrastructure win. The companies that treat it as a series of one-off pitches lose.

Build your touch point infrastructure now. Before you need it. Because when you finally need capital urgently, it will be too late to build familiarity.