The 3 Triggers That Make Investors Participate in Your Round

- Bella Battsengel

- 4 hours ago

- 6 min read

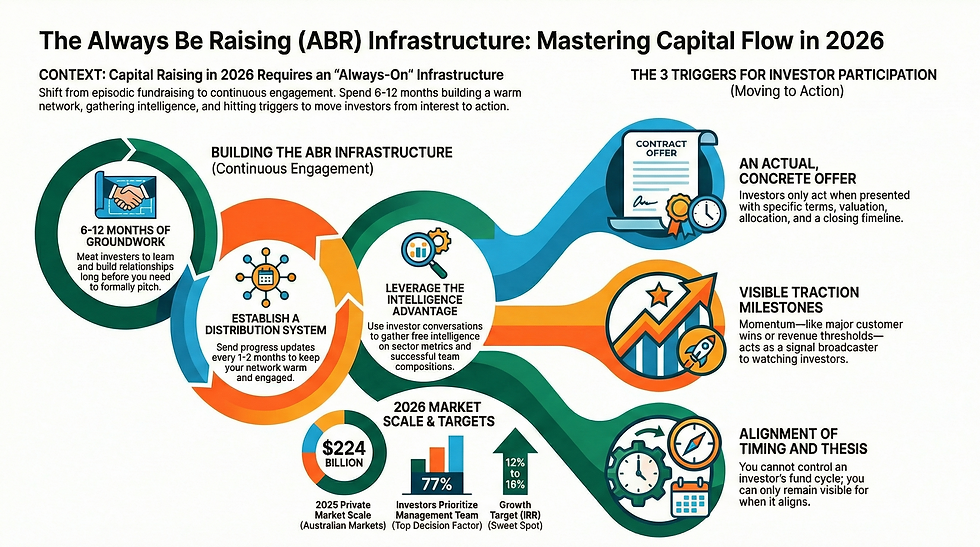

Most founders ask the wrong question about capital raising. They ask when they should start raising capital.

The answer is always be raising. ABR.

This is not sales advice translated to fundraising. This is the fundamental reality of how capital flows in 2026. If you have not seen this pattern in the hyperscaling AI companies over the last 24 months, you have not been paying attention.

Some companies have completed three to six rounds in the space of a year. Not because they are desperate. Because they are growing so fast that capital becomes the accelerant rather than the constraint.

But capital only flows when specific triggers activate investor participation. Without understanding these triggers, founders waste months pitching to investors who will never act.

The 3 Triggers That Make Investors Participate

There are only three things that move an investor to participate in your round. Not ten. Not five. Three.

Everything else is noise.

Trigger 1: An Actual Offer Exists

If you do not have an offer that investors can participate in, it is very hard for them to act. This seems obvious. It is not.

Investors can express interest. They can guide you towards creating an offer structure that suits them. They can signal willingness to participate at some undefined future point.

But ultimately, you still need an actual offer. Terms. Valuation. Allocation size. Timeline for close.

Without these concrete elements, investment interest remains theoretical. Investors are busy. They manage portfolios. They evaluate dozens of opportunities simultaneously. Theoretical interest does not translate to capital deployment without a clear participation mechanism.

This is why the always be raising mindset matters. You are not constantly closing rounds. You are constantly positioned to accept capital when investor interest converts to action.

Trigger 2: You Hit a Significant Traction Milestone and They Can See It

As you build your business, people start to see your growth. They feel buzz. They sense momentum. Whoever sits in your sphere of influence notices when you gain traction or achieve significant milestones.

Bringing on a major customer. Closing a strategic partnership. Hitting a revenue threshold. Securing regulatory approval. Launching in a new market.

These milestones create triggers. You often do not know which milestone will trigger which investor. But the pattern is consistent across public and private markets.

Look at listed companies. Most trading volume happens around significant announcements. ASX-listed companies see volume spikes when they release material news. The same dynamic applies to private capital raising.

You need to think about yourself the same way. Your business operates as a continuous signal broadcaster. Every milestone you achieve. Every customer you announce. Every partnership you close. These create micro-triggers in the minds of investors who are watching.

This is why investor relations infrastructure matters. You cannot rely on investors randomly discovering your milestones through LinkedIn posts or word of mouth. You need systematic communication that ensures every significant achievement reaches your investor network.

Trigger 3: It Aligns With Their Timing and Investment Thesis

Sometimes investors have an investment thesis that perfectly aligns with what you are doing. But the timing is not right.

They could be raising a new fund. They could have just deployed capital and need to reserve dry powder. They could be waiting for an exit to free up allocation capacity. Personal circumstances could interfere. Family issues. Health problems. Partner conflicts.

There are countless reasons why timing might not align. Most have nothing to do with your business quality.

This is the reality that founders struggle to accept. You can have the right company, the right sector, the right traction, and the right terms. But if investor timing does not align, they will not participate.

You cannot control investor timing. You can only ensure you are visible and engaged when their timing shifts.

Why Always Be Raising Is Not Optional in 2026

The question founders actually need to answer is not when to start raising. It is how to identify when these three triggers align for specific investors.

The answer is you should always be raising. Not literally closing rounds constantly. But always maintaining investor engagement infrastructure that allows you to recognise trigger moments.

Does this mean sending pitch decks to everyone constantly. No.

Does this mean asking for money in every conversation. No.

It means having ongoing conversations with investors. Learning what they are looking for. Understanding their key milestones and metrics. Getting their perspective on your sector. Building relationships before you need capital.

The Intelligence Advantage of Always Be Raising

When you are raising capital, if you are the one asking questions to investors rather than pitching, the amount of intelligence you gather becomes extremely valuable.

Investors understand what they are looking for. They have evaluated hundreds of companies in your sector. They know which milestones matter. Which metrics indicate genuine traction versus vanity metrics. Which team compositions succeed versus fail.

This intelligence is free. It requires only that you approach investor conversations as learning opportunities rather than sales pitches.

Ask them what they are looking for. What are the key milestones that would trigger their interest. What metrics matter most for companies at your stage. Get their helicopter view on your sector. Understand how they think about valuation. What competitive dynamics concern them. Which go-to-market strategies they have seen succeed.

All of this intelligence becomes actionable when you actually turn on a formal raise. You know exactly which investors to approach. What to emphasise in your pitch. Which milestones to prioritise. How to structure your offer.

Building Your Investor Distribution Infrastructure

After initial conversations with investors, ask if you can add them to your investor distribution list to keep them updated on your progress.

It would be very rare for someone to say no to this request.

This is the foundation of always be raising infrastructure. You are building an engaged investor network before you need capital. When you go out and have conversations with investors, you start to get better. Consider it practice. Warm-up sessions. Training.

Professional sports players do not only perform on match day. They attend practice sessions. They do warm-ups. They run training drills. This is your preparation work. Your groundwork before you enter a formal raise.

Once investors are on your distribution list, send updates every one to two months about progress and milestones. Make sure you connect with them on LinkedIn so they can subconsciously track your progress between formal updates.

When you communicate what you are doing, make sure it aligns with the capital raising brand elements. The investment signals that investors actually look for. Management team updates. New customers. Research partnerships. Grant funding. Sector momentum. Traction metrics.

These are the social proof points that align with investor thesis. These are the signals that prepare investors to act when trigger moments arrive.

The 6 to 12 Month Groundwork That Changes Everything

The key insight is this. Do the 6 to 12 months of groundwork before you need to formally raise capital.

Go and meet with investors. Not to pitch. To learn. Build relationships. Build your investor distribution list. Communicate progress every one to two months.

That way, when you start your capital raise, you are not starting it cold. You are starting with a warm, engaged list of people who know exactly what you are doing. Where you are up to. What you have achieved. What your ambitions are for the future.

This is the infrastructure advantage. This is why some founders raise capital in weeks whilst others struggle for months.

The difference is not the quality of the business. The difference is whether you have built always-on investor engagement infrastructure before you needed it.

The Reality of Capital Raising in 2026

Australian private markets raised $224 billion in 2025. Investor appetite for high-growth opportunities remains strong. Seed-stage deals captured 38% of investor interest. Series A and B rounds remained preferred at 45%. Pre-IPO opportunities saw 39% interest as the IPO market reopened.

Capital is available. The question is whether you have positioned yourself to capture it when investor triggers align.

According to recent surveys, 77% of investors highlight management team as the number one decision factor. But 43% are seeking opportunities that combine yield and growth. The sweet spot IRR target sits between 12% and 18% for growth-focused investors.

These investors are not waiting for founders to cold pitch them. They are monitoring their networks for trigger signals. New customer announcements. Traction milestones. Sector momentum shifts.

The founders capturing this capital are not the ones with the best pitch decks. They are the ones with the best investor engagement infrastructure.

What Happens When You Wait Too Long

Founders who wait until they desperately need capital before building investor relationships face a systematic disadvantage.

They start cold. Every conversation is a first conversation. They have no warm network to activate. They spend months building relationships that should have been built during their previous 12 months of operation.

Meanwhile, their runway burns. Their negotiating position weakens. Their urgency becomes obvious to investors, which impacts valuation and terms.

The founders who embrace always be raising avoid this trap entirely. When they need capital, they activate a warm network. When they hit traction milestones, investors are already watching. When they open a round, they have investors ready to participate because the groundwork was completed months earlier.

This is not about being constantly in fundraising mode. It is about building systematic investor engagement infrastructure that operates independently of whether you are currently raising.

The private market is professionalising. The infrastructure gap between founders with always-on investor relations and founders with fragmented communication is widening.

Those who build the infrastructure early will raise capital efficiently. Those who wait will wonder why investors never respond when they finally need capital urgently.

The best time to start building investor relationships was 12 months ago. The second best time is now.