The 7 Investor Signals Most Founders Miss in Capital Raises

- Bella Battsengel

- 1 day ago

- 6 min read

You have seconds of headspace when pitching to an investor. Not minutes. Seconds.

At every single moment, they are deciding whether to continue being interested in what you are doing. Each line they read. Each sentence that comes out of your mouth. They are constantly evaluating whether to stay engaged or move on.

This is not because investors are impatient. It is because humans are deletion creatures. We filter out noise to find signal. Investors see hundreds of opportunities. Most disappear into the noise within 30 seconds.

The difference between capturing attention and getting ignored comes down to specific signals. Not the signals most founders think matter. The signals investors are actually trained to look for.

Why Most Pitches Get Lost in Noise

Most founders approach capital raising by shouting numbers. Revenue projections. Growth rates. Market size calculations. They believe the business metrics will speak for themselves.

They do not.

Investors are not trying to understand your numbers in the first 30 seconds. They are trying to understand whether your opportunity deserves 30 more seconds of attention. Then another 30 seconds. Then a meeting.

This filtering happens unconsciously. The brain looks for patterns it recognises. Social proof elements that indicate this opportunity has already been validated by others. Credibility markers that suggest the team can execute.

Without these signals, your pitch becomes noise. With them, you become signal.

The 7 Capital Raising Brand Elements

These are not investment highlights. They are capital raising brand elements. Social proof points that build a credibility profile in seconds.

1. Management Team Track Record

Investors want to understand your "been there, done that" experience. Whether at the founder level, board level, or management team level. What companies have they been involved with that an investor might recognise.

This is about pedigree. Not experience in general. Specific, recognisable achievements that provide social proof. When you highlight who is involved in your business, you are telling investors these are the people who will execute and guide the plan.

The question in their mind is simple. Have these people successfully built something before.

2. Who Has Already Invested

Who has seen what you are doing and already backed your business. If you have not raised capital yet and have been self-funding, highlight how much you have personally invested. This demonstrates skin in the game.

If you have raised capital, highlight who the investors are. Both private investors and professional investors. Their names matter. Known angels, family offices, or venture capital firms serve as validation signals.

This tells investors that other intelligent people have looked at your business, conducted their own due diligence, and decided to back you. It reduces their perceived risk because someone else has already validated the opportunity.

3. Customer Social Proof for B2B Businesses

If you are a B2B business, highlight which customers you are currently working with. Focus on known brand names. Recognisable companies in your sector that are already utilising your product, service, or technology.

Investors want to understand who will actually buy your product. When you reference known brands, it signals that you have been through a procurement process. These companies evaluated your solution against alternatives and chose you.

This is particularly powerful in enterprise software, industrial technology, or any sector where customer acquisition requires navigating complex sales cycles.

4. Research Institution Partnerships for Technical Businesses

If you are a technical business, highlight which research institutions, universities, or research groups you have partnered with in the development of your technology.

The brain constantly looks for what it knows and understands. When you mention collaborations with recognised institutions, it signals that your technology has undergone academic or scientific validation.

It also suggests that you have gone through some form of technical due diligence process. These institutions do not partner with companies lightly. Their involvement serves as a credibility marker for the technical merit of your innovation.

5. Grant Funding as Validation

Have you received any grant funding. From government programmes, research bodies, or innovation agencies.

Grant funding is a powerful signal because the due diligence process for grants is often more rigorous than early-stage capital raising. You are evaluated at a technical level. Your innovation is assessed by domain experts. Your team is scrutinised for capability.

When investors see grant funding, they understand that your business has already survived a competitive evaluation process. This is particularly relevant for deep tech, life sciences, and healthcare companies where technical validation matters more than commercial traction in early stages.

6. Sector Momentum

Your sector matters. Sectors move in and out of favour. Sometimes for years. Sometimes for months. Investors understand that a rising tide lifts all boats.

If you are operating in a sector experiencing momentum, investors expect a natural uplift as part of their investment. This does not mean every hot sector company succeeds. It means the baseline probability of success increases when macro tailwinds exist.

In 2025, 55% of global venture capital went to AI companies. 70% of seed and Series A funding flowed to AI-related opportunities. This was not coincidence. This was sector momentum creating investor appetite.

Highlight how your business benefits from current sector trends. The convergence of technologies. Regulatory changes. Macro shifts in capital allocation.

7. Traction for B2C Businesses

If you are a B2C business, you need tangible traction. Month-on-month growth. Quarter-on-quarter growth. Year-on-year growth. Something concrete that investors can evaluate.

Revenue growth rates. User acquisition metrics. Retention cohorts. These numbers tell investors that your business has found product-market fit and can scale with capital injection.

Without traction, B2C businesses struggle to raise capital unless they have exceptional founder track records or unique distribution advantages. The market is too efficient. Competitors emerge too quickly. Traction is the validation signal that separates promising ideas from fundable businesses.

How These Signals Build Your Credibility Profile

These seven elements work together. Not independently. Each signal compounds the others to build a credibility profile in the investor's mind.

Strong management team plus known investors equals execution capability. Research institution partnerships plus grant funding equals technical validation. Customer social proof plus sector momentum equals market timing.

Investors process these signals unconsciously. They are not running through a checklist. They are pattern matching against thousands of previous opportunities they have evaluated. The brain identifies familiar markers and assigns credibility scores without deliberate thought.

This is why articulating these signals in the first 30 seconds matters. You are not trying to explain your entire business. You are trying to trigger pattern recognition that keeps them engaged long enough to hear the full story.

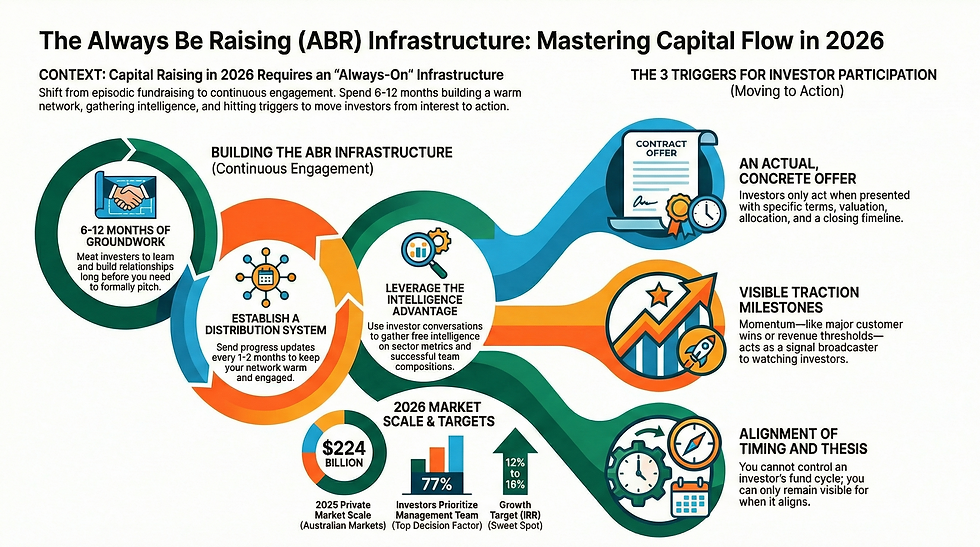

The Capital Raising Reality in 2026

The Australian private market raised $224 billion in 2025. There is capital available. Investor appetite exists for high-quality opportunities.

But the signal-to-noise ratio has never been worse. Investors receive hundreds of opportunities through fragmented emails, LinkedIn messages, and advisor introductions. Most pitches disappear within seconds because they fail to provide these fundamental signals.

According to recent investor surveys, 77% of investors highlight management team as the number one decision factor. Not the business model. Not the market size. The jockey matters more than the horse.

Seed-stage opportunities captured 38% of investor interest. Series A and B rounds remained the preferred entry point at 45%. But pre-IPO opportunities saw 39% investor interest as the IPO market technically reopened with 67 companies listing on the ASX.

The investors finding these opportunities are not sorting through every pitch that arrives. They are filtering for signal. The seven elements outlined above are the filter.

What Happens When You Cannot Articulate These Signals

If you cannot articulate these signals within seconds of presenting your opportunity, you get lost in the noise. Your business might be exceptional. Your technology might be breakthrough. Your market timing might be perfect.

None of it matters if you cannot capture attention long enough for investors to discover it.

Every investor is trying to understand what is signal versus what is noise. They have developed unconscious filtering mechanisms because the volume of opportunities makes deliberate evaluation impossible for every pitch.

The founders who understand this reality structure their capital raising around these signals. They lead with credibility markers. They provide social proof before financial projections. They demonstrate validation before asking for validation.

The founders who do not understand this reality wonder why investors never respond. Why meetings never convert to term sheets. Why their "better business" loses to competitors with worse technology but stronger signals.

The Infrastructure Advantage

The best founders in 2026 are not just optimising their pitch. They are building infrastructure that continuously broadcasts these signals to their investor network.

Always-on investor relations that highlight new customer wins. Automated updates when research partnerships expand. Systematic communication when grant funding arrives. Infrastructure that keeps investors engaged without manual effort.

This is the difference between founders who raise capital efficiently and founders who spend 80% of their time on administrative investor relations tasks. The infrastructure handles signal broadcasting. The founder focuses on building the business.

The private market is professionalising. The infrastructure is separating winners from losers. Those who understand what signals matter and how to systematically communicate them will capture disproportionate capital allocation.

Those who continue shouting numbers into the void will wonder why investors stopped listening.