Time Kills Deals: Why Your Due Diligence Process is Bleeding Momentum (And How to Fix It)

- Steve Torso

- Jan 23

- 3 min read

If you ask a founder what the hardest part of fundraising is, they will usually say "getting the first meeting" or "the valuation negotiation."

They are wrong. The hardest part, and the phase where most promising deals quietly die, is due diligence (DD).

There is an old adage in private capital: Time kills deals. Momentum is a tangible asset during a raise. The longer the process drags on, the more likely an investor is to get distracted by a newer, shinier deal or for market conditions to shift against you.

Yet most founders operate a due diligence process designed to be slow.

Based on my observations across thousands of deals, due diligence takes roughly 30% longer than it should. This isn't because the deals are complex. It’s because we lack a standard.

Every founder acts like they are the first person to ever build a data room. Every investor has to hunt for the same basic signals in a different, unfamiliar layout. The inefficiency is staggering, and the cost is paid in lost time.

The Groundhog Day of Fundraising

The primary engine of this inefficiency is email.

A typical post-pitch scenario looks like this: An investor is interested. They send over a list of preliminary questions. The founder spends four hours crafting a perfect, detailed email response. Two days later, another investor asks 60% of the same questions. The founder copy-pastes some answers, rewrites others, and hits send.

Repeat this across 20 investors.

Suddenly, the founder’s full-time job isn't running their company; it’s running a bespoke Q&A service for VC associates. This is unscalable, exhausting, and dangerous for deal momentum.

If you are writing long essays in emails to answer standard diligence questions, your process is broken.

Introducing The "Rule of Three"

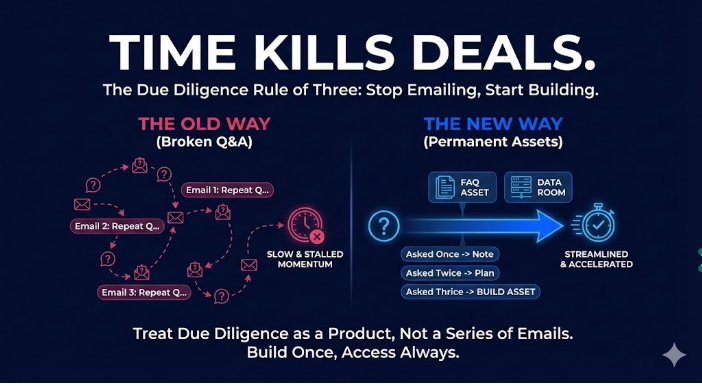

The solution is to stop treating due diligence as a series of conversations and start treating it as a product management challenge.

To break the cycle of repetitive emailing, I advise founders to adopt the "Rule of Three." It is a simple heuristic for identifying process failures.

The Rule: If different investors ask you the exact same question three times, stop answering it in emails.

If three separate entities need that piece of information to move forward, it is no longer a "question." It is a missing feature in your data room.

When you hit three strikes, you must stop typing replies. Instead, take that answer and turn it into a permanent, structured asset.

Building Assets vs. Answering Emails

The shift here is behavioural. You are moving from reactive "servicing" to proactive "building."

When you identify a "Rule of Three" question, where should the answer go?

1. The Pre-Meeting FAQ The highest-leverage place for standard questions (e.g., "What's your CAC payback period?" or "Who is on the cap table?") is a Frequently Asked Questions document that is accessible before the first meeting occurs.

The best founders arm investors with the basics ahead of time. This ensures the first meeting is spent discussing strategy and vision, not fact-checking basic metrics.

2. The Structured Data Room Asset If the question is more complex (e.g., "Explain the variance in your Q3 projections vs. actuals"), do not bury the explanation in an email thread that only one investor will see.

Write a structured memo explaining the variance. Convert it to a PDF. Upload it to the financial section of your data room with a clear title.

Now, when the next five investors ask that question, you don't write an email. You point them to the existing asset in the data room.

The Signalling Effect

Adopting this product mindset for due diligence does more than just save you dozens of hours. It signals competence.

When an investor asks a tough question, and you immediately direct them to a well-structured document that already exists in the data room, it shows you are disorganised.

Conversely, when an investor asks a standard question and receives a disorganised email three days later, they unconsciously begin to question your operational capability.

Investors expect friction in early-stage companies. But they want to see that you are capable of building infrastructure to remove that friction.

Stop Emailing, Start Building

The private capital ecosystem is currently built on fragmented emails and inconsistent updates. It doesn't serve anyone well.

While we wait for the industry-wide infrastructure to catch up, founders must take control of their own processes.

Stop treating due diligence as a conversational burden. Treat it as a product you build once, ship to everyone, and iterate based on feedback. Your momentum depends on it.